New to crypto? Cryptocurrency Basics is a 9 minute video that serves as a great intro to the world of crypto. It’s part of our Crypto and Web3 for Absolute Beginners course.

So… I didn’t mean to make this issue so focused on NFTs. It just sorta happened that way. I don’t always talk about NFTs… but when I do… ok nvm. I also didn’t mean to make this issue quite so long (I try to keep things under 5 minutes to read) but there was just so much interestingness to cover! I promise to never do it again (unless there’s once again a time when there’s too much interestingness to cover, obviously).

In this issue:

Current NFT status: UNSTOPPABLE!

What really makes Bitcoin… Bitcoin?

Why Ethereum still owns the NFT space

NITRO! (3 can’t-miss things)

Tools

Current NFT status: UNSTOPPABLE!

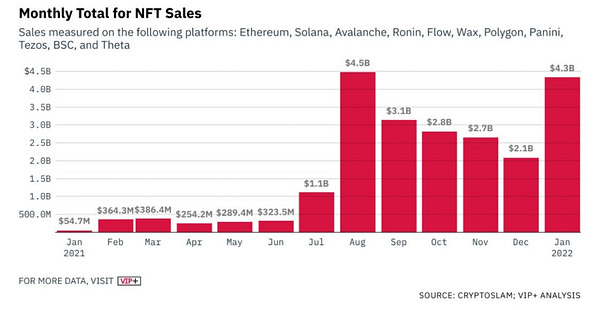

In the last issue we talked about all the big things happening in the crypto world despite recent price action. Well today you can feast your eyes on January’s NFT highs:

August saw the most NFT volume and then the following 4 months went dip, dip, dip and dip until boom: January arrived and volume skyrocketed once again (while the rest of the crypto space plummeted). Diversification, anyone?

What really makes Bitcoin… Bitcoin?

I don’t know about you but sometimes I almost get sick of hearing about Bitcoin (notice I said almost, ha). Don’t get me wrong — I still plan on buying more BTC — but it just seems like there are other, newer and, well, more exciting assets to potentially spend time and money on. Maybe that’s the key word though: seems.

Due to all the crazy Bitcoin maxis out there I have an automatic shield that goes up when someone starts talking about how different Bitcoin is versus other assets. However, when someone doesn’t also trash other assets in the same sentence (as if they have some kind of agenda) then I’m more open to listening.

Today that meant that I had my eyes opened a bit to some important nuances thanks to a report from Fidelity called Why Investors Need to Consider Bitcoin Separately From Other Digital Assets. It’s really thorough and in-depth (ie long) so let me pull out one paragraph that really made a light bulb go off for me:

“Because Bitcoin is currently the most decentralized and secure monetary network (relative to all other digital assets), a newer blockchain network and digital asset that tries to improve upon bitcoin as a monetary good will necessarily have to differentiate itself by sacrificing one or both of these properties. A competitor that tries to merely copy Bitcoin’s entire code will also fail as there will be no reason to switch from the largest monetary network to one that is completely identical but a fraction of the size.”

Wow. I had to read it a couple times to let it sink in but ya… it’s going to be hard to impossible to replace Bitcoin as a store of value asset. The crazy thing is: so many people who get into crypto think of assets like Bitcoin and Ethereum and Yield Guild Games and Mana as more or less doing the same things in slightly different ways… but that’s NOT the case at all. Bitcoin is it’s own thing. If other assets can manage to be their own things and carve out a reason for being then that’s great too (as all of the above projects have).

This whole topic kind of reminds of the advice you hear that goes something like: be yourself because you’ll never be a better version of the person you’re trying to copy (but for crypto).

H/t to Scott Melker for tipping me off to this via his premium newsletter.

Why Ethereum (still) owns the NFT space

In the section above we talked about why Bitcoin is so hard to replace. If you clicked through to the report I linked then you might have learned that it has a LOT to do with Bitcoin’s first-mover advantage. Well it turns out that Ethereum’s first-mover advantage really gives it a leg up in the NFT wars.

As William M. Peaster says in the latest issue of Metaversal:

Ethereum’s the first-mover smart contract platform and has accrued huge infrastructure and tooling advances over the years. In this regard, NFT users on Ethereum have vastly more apps and resources to benefit from or leverage.

Peaster also opines:

Ethereum has the largest and most active community of developers and creatives in crypto.

Superior infra + the most pioneering users = the best NFT liquidity in the cryptoeconomy today by a long shot.

Ethereum’s first NFT projects started in 2015. In other words, Ethereum’s NFT scene has the richest history and vastly predates the NFT scenes of all Ethereum’s contemporary alt-L1 competitors.

Because of their compelling history and dependability, Ethereum ERC-721 NFTs are considered by many NFT collectors to be the most desirable NFTs around.

He goes on to list some other interesting ideas, opinions and insights. The question is: do you agree with his assessment? I know Solana is trying to make a good go of it in the NFT space (and found some traction recently as high gas fees priced out many would-be buyers). I’ve heard things about Cardano NFTs.

Still: it’s hard to avoid the feeling (not the fact) that Ethereum NFTs are the real NFTs in many ways and that NFTs on other chains are knockoffs. Kinda like shoes associated with Michael Jordan have a different feeling and prestige compared to shoes associated with Shaq (regardless of their actual quality or utility as shoes).

NITRO!

Cool: NFT Price Floor is an easy way to see what the cheapest NFT in a given collection is.

News: Disney looks to hire NFT expert to lead its efforts in the space

Tools

TrendSpider: technical analysis software to speed up your analysis, automate grunt work, find winning chart setups and reduce costly analysis mistakes.

Paybis: buy Bitcoin and other assets with a credit or debit card.

See you tomorrow!